What are the real estate returns in Turkey? And how is it determined?

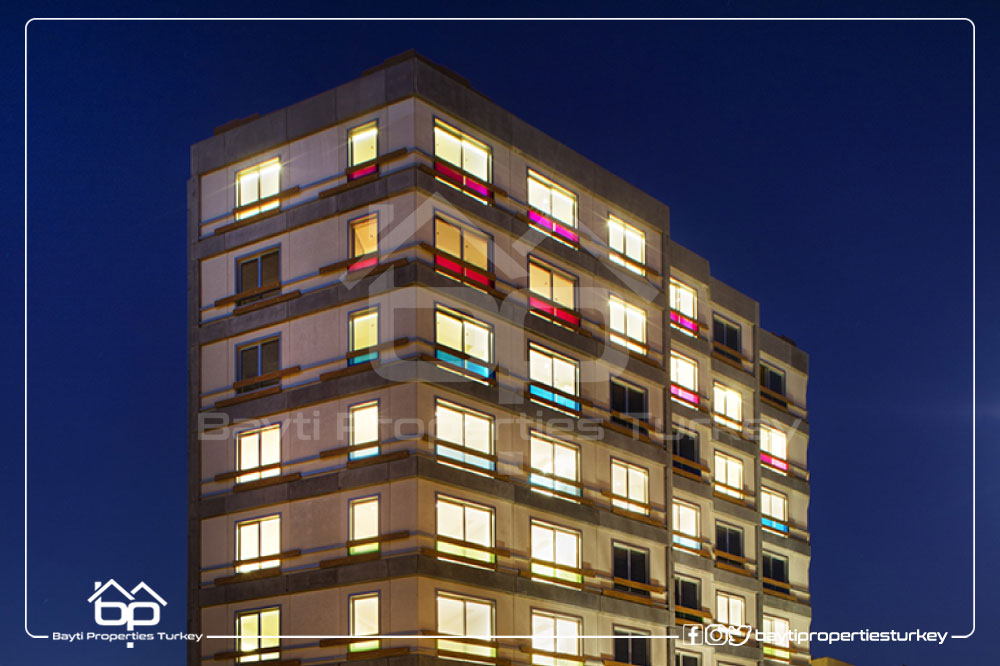

In conjunction with the Turkish government’s launch of a series of huge projects and strong infrastructure and the issuance of many laws and facilities in the field of real estate, the demand for buying properties in Turkey by investors and foreigners has increased intensely.

It also notes the large spread of the large residential complexes system equipped with all services, which makes it a good opportunity for housing and investment.

What are the returns in Turkey?

Apartment owners within the residential complex pay periodic fees for the services they receive such as basic services such as heating, cleaning, maintenance, security, and additional services such as gyms and other facilities and services. These fees are called revenues. These revenues are used to improve the building and provide it with smart solutions and add Service facilities.

A decision is made by the residents of the complex to collect the monthly returns from the residents of the apartments and in accordance with the Floor Ownership Law.

There are several things that you should pay attention to before paying the proceeds, which are:

Verify the value of the returns on the service of apartments in Turkey and compare this value with the services obtained.

Pay the amount only to the person responsible for receiving the proceeds on the service of apartments in Turkey.

You must obtain a receipt indicating that you have paid the value of the proceeds and are keen to keep it to guarantee your right as well as the right to manage the complex.

How is the value of revenue determined in Turkey:

Cooperating with professional companies specialized in providing the full services needed by the residents of the residential complex in Turkey, with all professionalism, in order to rationalize the use of the resources available within these complexes.

As for determining the expenses of residential complexes, they are determined based on the operating project. In the event that no special requirements or provisions are set within the management of the complex, Article No. 20 of the Floor Ownership Law shall be complied with, which stipulates that the expenses shall be distributed as follows: 50% for the staff 25% for energy and maintenance resources and 25% for complex management.

What services are provided for revenue in Turkey?

Security service: It is agreed with guarding and security companies with a high level of training to ensure the highest level of protection for all residents, day and night.

Cleaning service: The complex is kept clean by agreement with a company specialized in carrying garbage on a regular basis.

Elevator service: by regular maintenance of elevators to avoid any sudden malfunctions that may lead to their stoppage for long periods that hinder residents.

Gyms and swimming pools: This is an essential service within the residential complex.

Heating service, through which temperatures are maintained inside the residential complex, in addition to many additional services aimed at facilitating the lives of residents in the residential complex in Turkey.

What are the consequences of defaulting on revenue in Turkey?

In the event that the specified payment period in Turkey is exceeded, the complex or building management can apply a certain interest, in exchange for delaying the payment of returns.

According to the real estate laws in Turkey, the interest rate applicable to these payments can reach 5% of the amount value for each month in which the person is late in paying,

In the event of a significant default in the payment of the proceeds, the management of the complex may file a lawsuit against the property owner to the judicial authorities in Turkey, and the residential property may be seized or sold forcibly to pay the proceeds from the property owner.